On June 12, 2025, a Paytm share price crash shocked the market as One97 Communications saw a 10% intraday decline following the Finance Ministry’s denial of MDR rumors. This sharp drop occurred after the Finance Ministry clarified that the reintroduction of Merchant Discount Rate (MDR) charges on UPI transactions would not happen. The Paytm share price crash sparked market volatility and raised questions about the company’s future profitability.

The Indian stock market experienced extreme volatility as a result of this development, shocking investors and fintech enthusiasts. Whether you’re a current Paytm shareholder or considering an investment, it’s crucial to understand what led to the recent price drop, why it’s significant, and how it could affect your financial decisions.

Paytm’s Journey Before the Share Price Crash

Before we dive into what happened, let’s take a quick step back. Launched in 2010, Paytm initially focused on mobile recharges but gradually transformed into a comprehensive digital services platform. Over the years, it evolved into one of India’s biggest digital ecosystems, offering UPI transactions, bill payments, insurance, lending, ticket booking, and even stock trading—all in one app. The company became a household name, especially during demonetization in 2016, when cashless payments surged.

In 2021, Paytm launched one of the largest IPOs in Indian history, but the listing fell short of market expectations. Since then, the company has faced the constant challenge of balancing rapid growth with sustainable profitability. This makes any major financial update—like the recent MDR rumor—highly sensitive for both the company and its investors.

What Triggered the Paytm Share Price Crash?

- A sudden drop in the share price

- On June 12, 2025, Paytm shares began the trading session on a weaker note and tumbled by 10%, hitting an intraday low of ₹864.

- The decline rattled both institutional and retail investors, wiping out crores of market value.

- Understanding the reasons behind the Paytm share price crash helps investors avoid emotional decisions in the future.

Trigger: Rumor of MDR Fee Dispelled

There have been a lot of rumors on social media and financial blogs that MDR fees might be reimbursed for UPI payments. Platforms like Paytm could potentially increase their revenue by earning commission from merchants per transaction through MDR charges. However, the Indian Finance Ministry firmly denied the claims, labeling them as “untrue, unfounded, and deceptive.”

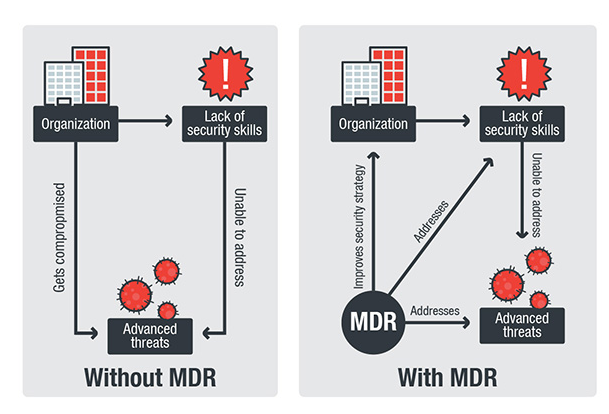

How MDR Rumors Fueled the Paytm Share Price Crash

The reason this rumor caused such a stir is that MDR could have been a game-changer for digital payment platforms like Paytm. With UPI transactions dominating India’s payment space, companies are under pressure to find ways to generate income from a service that millions use daily but that currently earns them nothing under the government’s zero-MDR policy.

Had MDR been reinstated, Paytm could’ve started earning a small fee from every UPI transaction made by merchants. While this amount might seem tiny per transaction, the volumes are massive—millions of UPI transactions occur daily. This could’ve opened up a new revenue stream at a time when Paytm is looking to boost its profit margins.

So, when the Finance Ministry dismissed the MDR news, it was like bursting a hopeful bubble for investors. This rumor played a significant role in triggering the Paytm share price crash, as many investors believed MDR charges could boost revenue. Many were betting on this policy change as a turning point for Paytm’s bottom line, and the denial led to quick panic selling.

Why is MDR important, and what is it?

When consumers make digital payments, merchants pay banks or payment gateways a fee known as the Merchant Discount Rate, or MDR.

Here’s why it matters:

- Present Situation with Feature Impact: No MDR for government-backed UPI payments

- Rumored Situation: Return of MDR = Higher profits for peers and Paytm

- The current reality is that without MDR, Paytm will not have any additional revenue streams.

MDR could have helped Paytm, which is already facing pressure to increase its profit margins. Investor disappointment brought on by the denial of this policy change caused the stock market to plummet.

Analyst Views on the Crash

Highlights of the UBS Report:

- Government or MDR incentives are essential for raising revenue.

- In the absence of these, Paytm’s adjusted core profits could drop by more than 10% in FY26 and FY27.

- Market analysts say that rather than real bad news, the market responded to lower expectations.

- In India’s fintech market, Paytm is still a major player, but investors now want transparency and profit margins.

Performance Summary (as of June 12, 2025)

Value of Metrics

- Day’s Low: ₹864; Intraday Drop: 10%

- Two times the typical daily trading volume is the volume surge.

- Bearish sentiment among investors

How the Paytm Share Price Crash Affects the Fintech Sector

These issues are not unique to Paytm.

Amazon Pay, Google Pay, and PhonePe are also active in the zero-MDR zone.

For all fintech companies, monetizing UPI-based services remains challenging. Although the government’s free UPI model benefits users, it restricts providers’ ability to make a profit.

As an investor, should you worry?

Here are some important lessons learned:

- Short-term volatility is anticipated, particularly because of market sentiment and false information.

- Long-term potential is contingent upon:

- Government subsidies and incentives

- Financial services cross-selling

- Growth in the investment, insurance, and lending sectors

- Keep an eye on the upcoming quarterly results, which will demonstrate how Paytm is doing without supplementary revenue streams like MDR.

If you often find yourself stuck in overthinking about money or investments, here’s a helpful guide on how to stop overthinking and start living fearlessly.

Final Word on the Paytm Share Price Crash

Investor sentiment fueled by unmet expectations, rather than a genuine business failure, was the direct cause of the June 12 Paytm share price crash. It’s not a death sentence, but it is a setback.

As usual, investors should evaluate the fundamentals and see past the noise. Paytm still has potential in India’s rapidly expanding digital economy if it can broaden its product offerings and lessen its dependency on UPI margins. The Paytm share price crash was driven more by investor emotion and unmet expectations than actual poor fundamentals.

In short, the Paytm share price crash wasn’t caused by weak fundamentals, but by investor overreaction and media speculation.

FAQ

Q1. What led to the Paytm share price crash on June 12, 2025?

The Finance Ministry’s clarification that MDR fees on UPI will not be reimbursed caused a decline in Paytm shares, eliminating a possible source of income.

Q2. What does MDR mean, and why does it play a crucial role in digital payment ecosystems?

The Merchant Discount Rate (MDR) is a charge that merchants pay to banks or payment gateways for processing digital payment transactions. Businesses like Paytm would have made more money if they had returned.

Q3. Is now a good time to purchase Paytm stock?

Despite being a powerful fintech player, Paytm is a risky short-term investment due to its low profit margins and current regulatory uncertainties. After the quarterly results, evaluate.

Q4. Is there a possibility that the government might bring back MDR charges in the future?

Since the Indian government strongly supports UPI’s free model, there is no official indication that MDR will return anytime soon.

Q5. What ought Paytm to do next?

Instead of depending on UPI MDR or government incentives, Paytm should concentrate on growing lending, insurance, wealth management, and offline payments.

Kalden Doma

An internationally renowned thought leader in rediscovering & mind training life skills. Kalden Doma has been delivering inspirational lectures across the globe for over 17 years. A driven entrepreneur, started a mind training academy in 2001. She coaches students, entrepreneurs, & executives.